Award-winning PDF software

additional insured - controlling interest

If the candidate: 1. Has not filed a Statement of Organization that includes the required statement of principles, in accordance with applicable law; 2. Has not filed a Financial Disclosure Statement within sixty days of nomination, with the Office of Government Ethics, and the Office of Government Ethics has informed the candidate in writing that the filer's report was incomplete; or. 3. Has not filed a Financial Disclosure Statement within sixty days of nomination, is in default on a Federal Election Commission Form 4 or other campaign contribution report, has not signed and filed a Statement of Organization, Statement of Candidacy or Campaign Report with the Office of Government Ethics or is unable to provide the requested certification document for any reason, the Ethics Commission will not certify this endorsement. If the candidate has filed any of the required documents and there is any missing page from the documents, the Ethics Commission will.

additional insured – controlling interest

A. Section III – The Insurance Company's Report to the Secretary. A. B. 1 – What is the Report? The insurance company will prepare a report stating that the person(s) or organization(s) has a liability policy, that the insurer has the authority to pay (or not to pay) the amounts specified in the insurer's policy, and will show that the amount of liability and payments is correct. A. B. 2 – What is the Report not To Be Furnished? A. B. 1 – What is to be Included in the Report? The report will include the name, residence address and telephone number (including area code) of each person(s) or organization(s) and the name(s) and address of the insurer or insurance agent. A. B. 3 – What is not to be Included in the Report? The report will not include: 1. an itemization under a policy of the portion of any payment that would: 1..

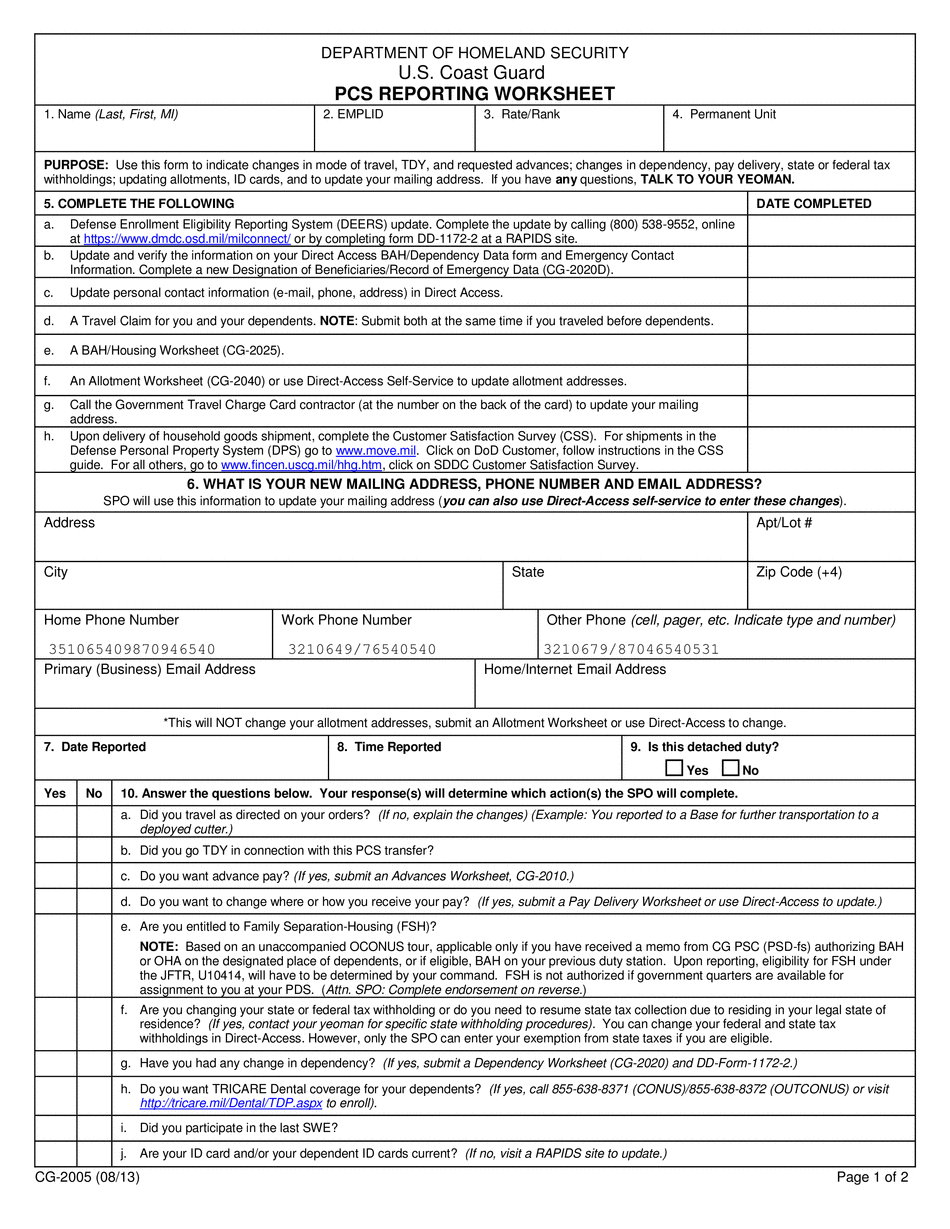

us coast guard - pcs reporting worksheet - department of

Required Information: Name (1–30 letters): Business name: PCS reporting address: Phone: Date of birth (MM dd-HH mm-SS): Race: Sex: Gender: Marital status: Driver's license/State ID number(s): Address: Street address: City/Town/State: Zip code: Occupation: Phone number (including area code): Date of issue: (If no issues issued after January 1, 2007, DO NOT enter any zip or area code) PCS Status: PCS Number: PCS Issuing Unit: PCS Number: PCS Status: PCS Number: PCS Issuing Unit: PCS Number: The PCS Number is a 14-digit number assigned by DHS by each state or territory. This system is designed to enable the state or territory to identify the number of PCS holders registered and/or eligible for the state's PCS program, and enables this information to be used by DHS to develop an effective PCS program to assist in the management of the program. State governments are encouraged to update the database frequently. The PCS Number is also used for identification purposes with various other government programs and programs administered by multiple jurisdictions. This includes Medicaid, Medicare, Unemployment Insurance, Social Security, Social Security.

Form cg-2005 "pcs reporting worksheet" - templateroller

This is a legal form that was released by the United States Coast Guards on November 20, 2017, and used country-wide. As of today, no separate filing guidelines and/or requirements. This is a legal form that was released by the United States Coast Guards on May 1, 2005, and used country-wide. As of today, no separate filing guidelines or requirements. This form was released by the United States Coast Guards on March 24, 2003, and used country-wide. As of August 28, 2016, the USCG is no longer used and the USCGC-V-P is as of now the sole form of recognition for Coast Guard members. This is a legal form that was released by the United States Coast Guards on October 5, 2011, and used country-wide. As of today, no separate filing guidelines and/or requirements. This form was released by the United States Coast Guards on May 12, 2014, and used country-wide. As of now for.

Coast guard (cg) authorized forms

This is a major headache for anyone that has already submitted and received a Form W-2. Not only must they find a new W-2, but they will also need to create a new paper check on the Form W-2. Let's look at one last set of numbers and a long string of numbers for you to look through at your own convenience. First, let's assume that this individual filed his or her taxes on March 15 and received a Form 1040-ES. Let's say that they made the full payment by check which left a check of 5, with PayPal. In this example, in just 12 days, PayPal received about (5, + 3, = 7,) via two transactions. (PayPal amount deposited on 8/28/2016). 7, — — 7, = 5, 1, (PayPal amount deposited on 8/28/2016). 5, (PayPal amount deposited on 8/28/2016). 1, (PayPal amount deposited on 8/28/2016). Now, let's say that the IRS was.